When families start planning for long-term care or crisis situations, they often come face-to-face with a pile of legal documents that all seem to say the same thing. Clients ask us all the time: Do we really need all of these?

If you’ve ever had those questions, or heard them from loved ones, the latest episode of Elder Law Out Loud is for you. And this blog will walk you through the basics so you can listen with confidence.

Why Advance Directives Matter

Advance directives are legal tools that allow you to stay in control of your health, finances, and end-of-life choices, even when you can’t speak for yourself. They prevent confusion, protect your wishes, and reduce stress for the people you love.

But here’s the tricky part:

These documents often sound alike, overlap in certain areas, and use similar terminology… but each one has a very specific (and very different) job.

Let’s break them down.

Durable Power of Attorney (DPOA): Your Financial Decision-Maker

What it is:

A Durable Power of Attorney is a document that appoints someone you trust to make financial and legal decisions on your behalf.

Think:

- Accessing bank accounts

- Paying bills

- Selling property

- Signing contracts

- Handling Medicaid planning steps

Why it’s confusing:

People often think the DPOA lets someone make medical decisions. It doesn’t. Unless a specific clause is added, medical authority lives in a different document altogether.

Why it matters:

Without a valid, broad DPOA, your loved ones may need to pursue guardianship- a court process that is expensive, public, and slow- just to help manage your affairs.

Health Care Surrogate (HCS): Your Medical Voice

What it is:

This directive names the person who will make healthcare decisions when you cannot.

Think:

- Approving or refusing treatments

- Choosing doctors or facilities

- Accessing medical records

Why it’s confusing:

Because many people assume being named in a DPOA automatically gives this authority. It doesn’t. Florida law treats medical decision-making separately unless the document clearly combines the roles.

Why it matters:

Doctors need clear, legally recognized authority before they follow someone’s direction. Having an HCS form avoids delays in emergencies.

Living Will: Your Voice on End-of-Life Care

What it is:

A living will expresses your preferences for life-prolonging treatments if you are terminal, in a persistent vegetative state, or have an end-stage condition.

Think:

- Artificial ventilation

- Feeding tubes

- CPR

- Pain management

Why it’s confusing:

People hear “will” and assume it covers inheritance or property—not the case. This document is specifically about medical treatment at the end of life.

Why it matters:

It relieves loved ones from making impossible choices, and ensures your wishes—not someone’s guess—guide your care.

Final Disposition Instructions: Your Wishes After Death

What it is:

This directive spells out what should happen to your body after your passing.

Think:

- Burial or cremation

- Organ or tissue donation

- Religious or cultural preferences

- Instructions for services

Why it’s confusing:

Many people assume this is covered in a last will and testament. But funerals and cremations happen long before a will is even opened. That’s why this document stands alone.

Why it matters:

It removes decision-making burdens during grief and makes sure final arrangements follow your values and intentions.

Why They Sound the Same… But Aren’t

Each document deals with times when you’re unable to act or speak for yourself. Each involves choosing someone you trust. And yes, there is some overlapping language.

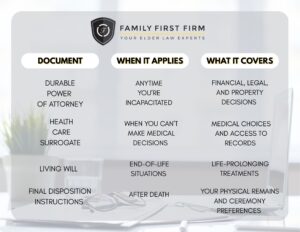

But the most important difference is timing and authority. Save this photo for quick reference:

Together, these directives form a complete roadmap for your loved ones and care providers.

Key Takeaway: They All Work Together

Our episode breaks down why relying on just one- or assuming one covers everything- can create real problems for families. Having a comprehensive package gives you:

- Clarity for your family

- Protection for your assets

- Autonomy over your medical care

- Peace of mind during life and after

If you’ve procrastinated on this piece of planning, this podcast episode is your sign to finally check it off the list.

Listen to the Full Episode

Dive deeper into real-life scenarios, common mistakes, and how to make sure your documents will hold up when you need them most.

Whether you’re planning ahead or responding to a sudden care need, this episode is a must-hear for anyone supporting an aging loved one. Don’t miss the insights and practical tips that could change your family’s future.

Elder Law Out Loud is a monthly podcast co-hosted by Family First Firm CEO Geoff Hoatson and Public Relations Manager Karla Ray. For inquiries, contact karla.ray@fff.law.